Other economic indicators

Keep abreast of key economic indicators.

American economy

Updated June 12, 2025

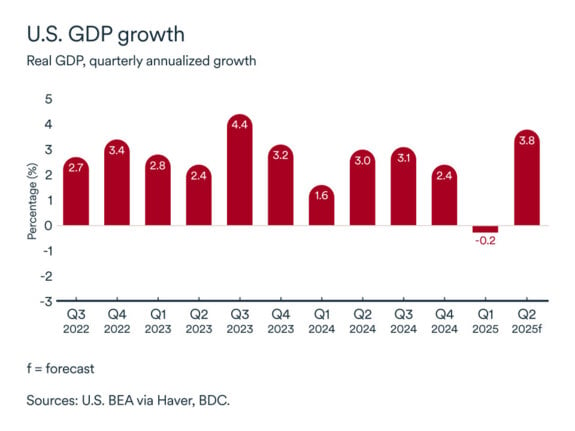

The U.S. economy regains strength

The latest economic estimates point to a solid rebound in US GDP in the second quarter, at around +3.8% according to the Federal Reserve Bank of Atlanta. Growth in consumer spending is said to have risen by 2.5% over the quarter, while investment is said to have fallen by 1.9%. Impressive results, but also indicative of the slowdown in the first three months of 2025.

The U.S. Federal Reserve will be relieved to see that inflation finally fell in May to 2.4%, while the labour market showed further signs of stabilization. However, the federal funds rate is unlikely to budge between now and the end of summer, as underlying inflation measures remain well above their targets.

Foreign tourism and travel to the United States have plummeted so far this year.

The impact on your business

- Strong consumer spending will continue to drive growth in the U.S., which could boost demand for Canadian goods and services, particularly in sectors such as retail and manufacturing.

- Canadian companies could benefit from increased demand for their exports. Despite higher tariffs, inflation in the U.S. does not seem to be picking up.

- The promising outlook in the United States is generating investment opportunities, particularly in cross-border projects, since Canada is still well positioned compared to other countries to supply the U.S. market.

Proven strategies

- If you're worried about tariffs, check out Canada Tariff Finder , a free online tool that enables Canadian exporters to find out the tariffs applicable to a specific product in a foreign market.

- If you're thinking of expanding your business outside of Canada or diversifying your market beyond the U.S.: 4 tips for successfully exporting your services

Oil market

Updated June 16, 2025

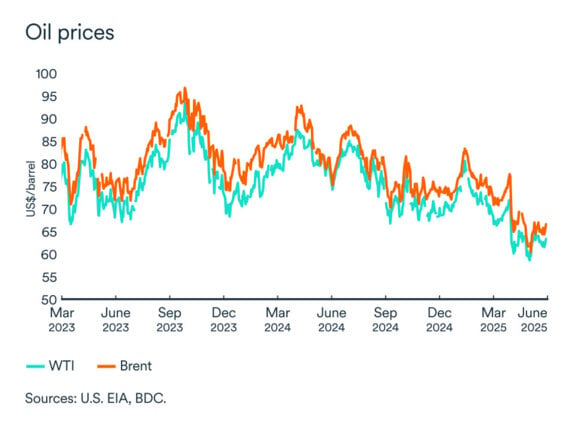

Oil prices rise in June

Economic uncertainty is still very much with us on the oil market and is set to continue into 2025. Oil benchmarks rallied in June on the back of optimism over a Sino-American agreement, rising geopolitical tensions in the Middle East, and falling crude reserves in the US. Market conditions seem to favour WTI more than Brent, which was trading at US$73 at the same time, while WTI has surpassed US$71.

Prices quickly recovered on the market. OPEC members are resuming production albeit timidly.

The impact on your business

- Fluctuating oil prices can have a direct impact on the cost of transport and logistics. Lower oil prices can reduce fuel costs, which in turn can lower the cost of producing goods and services.

- SMEs in energy-intensive sectors such as manufacturing and agriculture are more sensitive to movements in the oil market. If you operate in or deal heavily with these sectors, you may feel the impact of changes more quickly.

- High oil prices can reduce consumers' disposable income, leading to lower spending on non-essential goods and services. Lower prices at the pump can have a positive impact on SMEs in consumer discretionary sectors.

Proven strategies

- The price of energy products can be a determining factor in your cost structure. They also impact on consumers' budgets in general. A good cost management and pricing strategy can set you apart from your competitors.

Exchange rates

Updated June 12, 2025

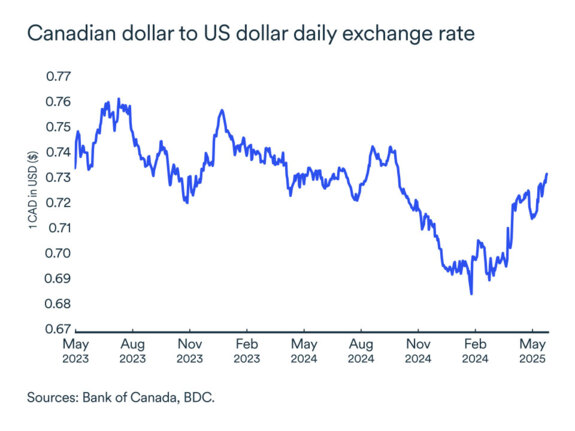

The loonie slowly rises

The Canadian dollar began its gentle ascent a few weeks ago. The loonie was trading slightly below 74 US cents in mid-June. The Canadian dollar's recent rise against the greenback has been accelerated by more positive statements about relations between Canada and the United States. However, the threat of tariffs against numerous overseas partners could hurt the Canadian economy in the short term. The spread between U.S. Federal Reserve and Bank of Canada interest rates is being maintained, which is also limiting the value of the loonie against the greenback. The Canadian dollar could approach US$0.75 if oil continues its upward trend and negotiations with Washington continue to improve.

The impact on your business

- In general, the Canadian dollar's impact on SMEs will depend on the nature of your business and its dependence on imports versus exports.

- A weak Canadian dollar supports exports. If, on the other hand, you are importing inputs or machinery, your operating costs could rise in the coming months.

Proven strategies

- It's important for SMEs to manage currency risks and consider strategies to mitigate potential negative effects. Find out how to manage foreign exchange risk when selling abroad.

Interest rates

Updated June 12, 2025

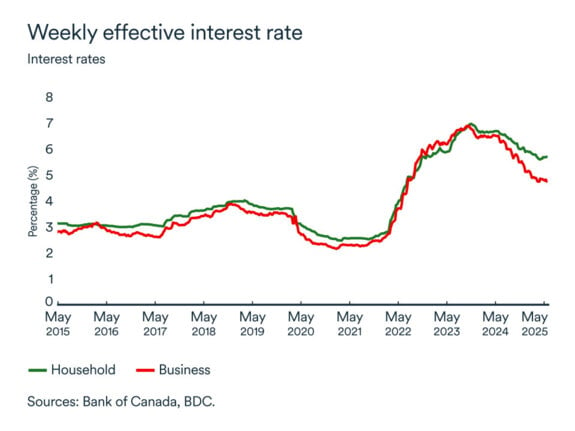

Is the Bank of Canada done with rate cuts?

The last change to the Bank of Canada's monetary policy was a 25-basis-point cut in March 2025. Since then, the Board of Governors of Canada's central bank has opted for the status quo. The June announcement reflects a degree of confidence in the resilience of the Canadian economy, and a willingness on the part of the central bank to take a closer look at the effects of existing tariffs on inflation.

Inflation is still under control in the country, but at 2.75%, the key rate has reached the neutral rate (i.e., it neither stimulates nor hinders growth), so it could be that the Central Bank has finished easing credit conditions in the country.

Over the past 12 months, the key interest rate has been cut by a cumulative 225 points. Since then, effective rates for households have fallen by 92 points, and those for businesses by 163 points.

The impact on your business

- Interest rate cuts have improved household and business confidence, which bodes well for the economy as a whole.

- However, businesses need to remain patient, as economic recovery will be gradual as the soft landing continues. Full economic recovery will take a few more months, and persistent sectoral challenges remain

Proven strategies

- Keep a close eye on interest rates to optimize your company's financial situation. The commercial loan calculator will help you determine the interest associated with your loan.

- With rates still trending downwards, it's a good time to plan your future investment projects. Use our financial tools to calculate your company's debt-to-equity ratio, as well as other important ratios that banks take into account when evaluating loan applications.

Residential market

Updated June 16, 2025

Improvements nationwide

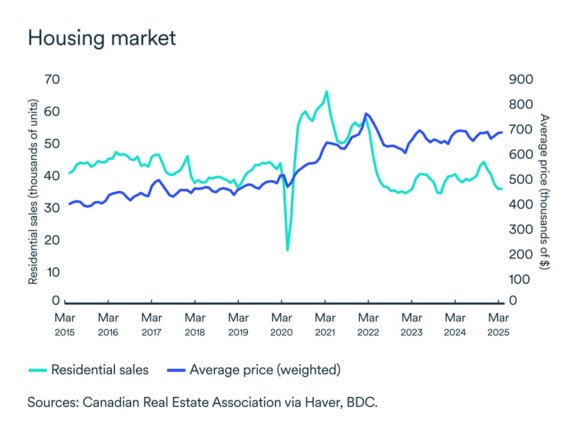

Activity seems to be picking up on the residential resale market, with the number of transactions recorded in May finally picking up. Average home prices continued to fall, but only modestly, while the MLS home price index remained stable.

Mortgages amortized over 30 years have been popular with Canadian households since the policy came into effect in mid-December. This measure allows homeowners to reduce their payments, leaving them with more to spend elsewhere.

The impact on your business

- Businesses operating in the residential, construction and furniture sectors will be among the first to feel stronger demand, caused by lower interest rates. An earlier transmission time in this sector indicates that the trough is finally behind us.

- Even if your company is not directly dependent on the residential sector, trends in this market have consequences for all businesses. For one thing, housing is consumers' biggest budget item. What's more, according to a new survey by KPMG Canada, business leaders see the housing crisis as the greatest risk to the economy. The affordability issue weighs heavily on executives as they strive to attract and retain the staff they need for their operations.

Proven strategies

SME confidence

Updated June 12, 2025

Business confidence returns

Optimism among Canadian businesses improved significantly in May. The CFIB business confidence index for the year ahead, which had fallen in April, rose by almost five points. This has still not enabled it to reach 50, the neutral level. An indicator of 50 means that as many business leaders expect the business environment to deteriorate as to improve over the period covered (12 or 3 months).

The index thus seems to confirm that business leaders are quietly returning to optimism, probably partly in response to the more favourable announcements relating to North American relations. It remains to be seen whether this trend will continue in the months ahead, given the continuing high level of uncertainty hanging over the heads of Canadian businesses.

The impact on your business

- Business confidence plays a crucial role in shaping the strategic decisions and growth potential of SMEs. When business confidence is high, SMEs are more likely to invest in new projects, technology and hiring.

- It is important for SMEs to monitor economic indicators in order to make informed decisions.

Proven strategies

- Knowing that optimism seems to be returning among Canadian companies, make sure you too have a vision aligned with the external environment, so you don't find yourself at the back of the pack. Plan your strategy accordingly.